Disclaimer: This system is for the use of Authorized users only. Individuals using this system with authority, without authority, or in excess of their authority, are subject to having all of their activities on this system monitored and recorded by system personnel. In the course of monitoring individuals improperly using the system, or in the course of system maintenance, the activities of Authorized users may also be monitored. Anyone using this system expressly consents to such monitoring and is advised that if such monitoring reveals possible evidence of such monitoring to law enforcement officials.

The Liquidice® Investment Module has been enhanced to support calculations for Compounding and Partial Redemptions and provide an accurate computation of interest accruals and partial redemption amounts. Additionally, now Liquidice has support for Secondary Market Purchases of Fixed Income Securities, allowing users to adjust their holdings in response to changing market dynamics.

We have enhanced the Payment Management and Visualization Capabilities of the Liquidice® Payment Module to improve your ability to track, manage, and analyse payment transaction data with more visibility, control, and transparency. With these new capabilities you can now analyse payment trends, easily manage large payment batches, without compromising on your stringent compliance and audit requirements.

Liquidice® System Administration Module has now been enhanced by streamlining the administration workflows with improved data security & user experience. Liquidice® now supports ‘Client Secret’ Key Management through a UI. Now, Client Secrets can be updated directly through the Liquidice® UI, thus enabling a customer to respond swiftly to address new security requirements or any operational changes. Additionally, Liquidice® now supports archival of communication data, thereby allowing you to securely store historical communication records for future reference and compliance.

Liquidice® Inter Corporate Loans (ICL) Management Module supports Setup, Management, Tracking, Approval & Execution of Unilateral Lending / Borrowing Limits (basis Board Resolutions), Bilateral Lending / Borrowing Agreements. Users can now Initiate, Authorize and Execute Inter Company Loan Payment Transactions and Loan Repayment Transactions. In addition, Liquidice® now supports computation and payment of Accrued Interest on ICL Transactions.

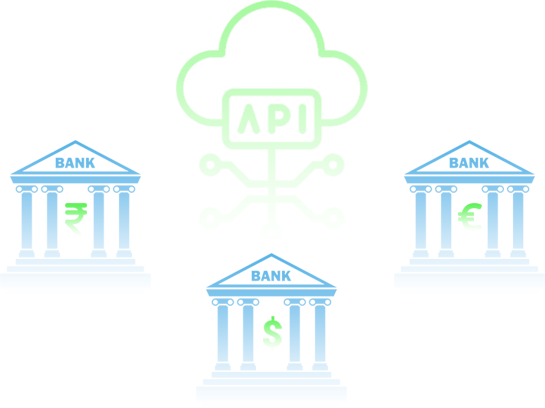

Liquidice® has out-of-the-box connectivity with Balance & Transaction Enquiry APIs, Payment APIs & Payment Enquiry APIs of leading Local and Multinational Banks across South-Asia, ASEAN, MEA, EU, UK & the Americas, to help Corporate Treasuries eliminate the complexity, costs & risks involved in building & maintaining bespoke connectivity with each Bank.

Liquidice® enables the Payment Factories & Shared Service Centers (SSC's) of Global BPM Companies to Centrally configure, execute, monitor & control their Accounts Payable (AP) Processes across multiple Countries & Currencies, using the inbuilt Payment API Adaptors in Liquidice® for the Local & Multinational Banks in these Countries.